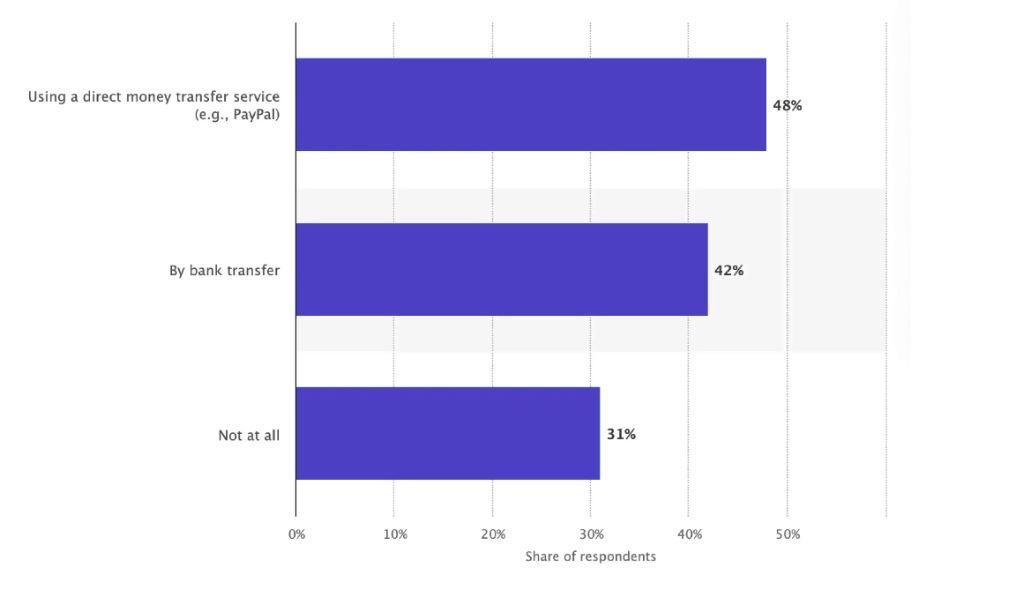

Modern tech helps us gradually forget all about traditional cash payments. The world is turning full-on mobile, and peer-to-peer transactions are becoming a new norm. According to Consumer Reports, four out of ten Americans conduct P2P (peer-to-peer or person-to-person) payments at least once a month. And the overwhelming majority (78%) have not encountered any issues with the services. It is expected that by 2026, the volume of P2P transactions will increase to nearly $2.3 trillion per year.

In other words, P2P is convenient, secure, and promising. But this is a huge market, so there is serious competition in the field of P2P payment app development. EXB Soft has been implementing reliable FinTech solutions for platforms of all types and scales for years now.

Let’s discuss the nuances of creating P2P applications to help your company stay ahead in the race of technologies.

Utilization of peer-to-peer payment apps as of June 2023

Peer-to-Peer Payment Apps

Although digital payment methods have evolved gradually over the years, many entrepreneurs still rely on rather archaic methods. However, in recent years, P2P applications have had a significant impact on global users due to advantages like:

- Digital transactions are faster, more transparent, and more flexible than traditional methods.

- They easily integrate with users' social life structures.

- Financial management becomes more optimized.

- Peer-to-peer loans are more accessible, and the process of obtaining them takes less time.

- P2P is available 24/7 and allows transferring money to all sorts of bank cards.

- You get access to personal transaction history.

That being said, developing solutions to power P2P payments can be quite profitable in areas such as:

- Retail trade and B2C services: P2P apps help users settle orders easily and quickly.|

- Financial institutions: Companies can offer users various cards or create internal payment systems without involving banks.

- Telecommunications, logistics, and technology companies: With a mobile wallet, enterprises can integrate cards from different banks into one environment.

- Private payments: Electronic wallets can be used to send money to credit/debit cards to lend to someone, financially assist family and friends, etc.

- Other areas: P2P applications are convenient for non-commercial fundraising, anonymous transfers, etc.

The P2P payment market offers startups opportunities for innovation, allows existing financial software providers to diversify their offerings, and encourages social media platforms to remain competitive. On top of that, the growth of the global smartphone user base further enhances the potential for business expansion in this sector. While we’ve already discussed how to create a fintech app, now let’s focus on P2P solutions.

Types of P2P Payment App Business Models

The number of popular P2P solutions is growing year by year. But the most in-demand ones today are these types:

Mobile OS-compatible

Perhaps the most popular P2P services include Android Pay and Apple Pay. Interestingly, these are not even full-blown applications but built-in features of devices that support NFC technology. The downside is that both solutions limit money transfers to a single system (either Android or Apple). On the other hand, users can make fast payments without leaving messaging apps.

Bank-centric

Although most banking institutions have their own dedicated solutions, external P2P payment apps facilitate fund transfers through partner banks and credit unions. These apps allow users to send money, pay bills, and manage their finances directly via their existing bank accounts.

They are usually integrated with traditional banking applications or offered as additional services by banks. For instance, Dwolla and Zelle are bank-centric solutions that can connect with point-of-sale terminals (PoS).

Standalone

This type of of P2P app is independent of financial institutions, has its own autonomous management and asset security systems. Digital wallets let you keep money inside a protected system, make card payments, or conduct peer-to-peer transactions on command. Examples include PayPal and Venmo.

Social media-centric

Such applications allow transferring funds from bank cards without leaving social platforms using integrated P2P payment features. Users can send money to the recipient contacts through messengers. Social media-centric apps use the user's social connections to create a payment ecosystem. When developing one, focus on user privacy and consent to access contact lists, as well as seamless integration with the social media platform's interface.

Must-have Features for a P2P Payment App

To provide users with a seamless experience, your application must grant certain key functionalities.

Digital wallet

A personal space for financial management allows users to securely store funds and card details, send invoices and money requests, and make electronic transactions and transfers to bank accounts. A good P2P app has a simple and secure account creation, authentication, and bank account linking flow.

Currency conversion

P2P users must be able to conduct cross-border transactions with a P2P solution. The ideal way to implement such a solution is to synchronize the payment application with the bank's currency exchange rate at the time of the transaction.

Unique ID/OTP

If a user plans to perform any operation in the P2P payment application, they need to first verify and confirm a unique ID and OTP (one-time password). This is necessary to enhance security and prevent unwanted or accidental transactions. If the device has a built-in fingerprint scanner or face recognition, they can use it to confirm the transaction.

Push notifications

Users need real-time notifications about all critical processes regarding their transactions and funds (e.g., completed or canceled transfers). This is important for both convenience and transaction security, as well as for promoting new special offers.

Chat

The chat feature comes in helpful when users need to clarify specific details related to the payment, they should be able to do so directly in the application. This will help avoid risks and indiscreet errors during transactions.

History

Users should be able to see all their transactions, received and sent payments, and dates and times of all operations. This is a must-have feature to keep users informed and satisfied with the app.

Support

Users need a fast and efficient responsive support system to assist with payments, account issues, or just general questions. You can provide multiple support channels such as chat, email, or phone contact with clear response times.

You can add as many extra features as you wish, of course. Overall, an up-to-standard P2P payment app must facilitate and safeguard financial management for a simple individual.

How to Build a P2P Payment App

Your product should be functional and customer-friendly, rung quickly, seamlessly, and securely. Achieving such a result calls for a well-adjusted workflow. Here’s how you can structure it:

Choose the type of application

Banking and standalone solutions are the most common. The most promising choice in terms of RoI, however, will be a P2P Android app. Still, you can choose any option based on careful study and your own vision of your position in the market.

Select the technology stack

Advanced tech and tools power the creation of a better, faster, more convenient, and profitable product. Employ the latest achievements in fintech P2P, including NFC, Blockchain, artificial intelligence, biometric identification, and others.

Design the UI

The application should attract users with the simplicity of usability rather than a variety of complex-to-understand functions. It should be intuitive and visually appealing. You can enhance user engagement with a minimalistic interface and hassle-free UX that doesn’t throw bothersome elements at the user (like ads or tutorials that cannot be disabled).

Handle security and compliance

Information about accounts, transaction history, and fund transfer processes must be securely protected. You can enable fingerprint scanning, facial recognition, two-factor authentication, and other security features. The app must also comply with the standards and payment laws in the region. Study local legislation and PCI-DSS standards and adapt your product to them.

Test and support

It is better to run through the P2P money transfer app’s overall functionality at every stage of its development. This way, you’ll avoid issues that are impossible to fix later on. And post-launch testing will help understand how functional and user-friendly your product is in action. To measure post-launch testing efficiency, study reviews and ratings. This will help to timely fix bugs and mismatches in user expectations.

Surely, you need a seasoned team of developers to handle all of the above. If you don't have one yet, EXB Soft can help. Our dedicated team has the tools, experience, and expertise to bring the boldest ideas to life.

P2P Development Challenges

To create a sought-after product, you will have to overcome all the pitfalls:

Geographical limitations

Different regions have different rules and norms, and it is difficult to create an application that will comply with all standards. Make sure to consider local regulatory restrictions during the development.

Dispute resolution

It is impossible to completely eliminate potential issues with transactions. Your app should outline and register all user actions in cases of dispute. There should also be access to round-the-clock support regardless of their location.

Lack of open loop solutions

Compatibility between the payer and payee on one platform is crucial. Especially when transactions are made with someone you don't know. An open-loop platform allows for the convenient transfer of funds to/from any type of payment gateway, eliminating the need to connect parties through a single platform or provide extra personal information.

Security

High vulnerability is one of the biggest problems in P2P payments. Since a huge amount of confidential data is stored in one place, payment service providers must create secure data management systems.

Compliance with PCI DSS

It is extremely important for a product dealing with confidential banking information to comply with PCI DSS requirements. To obtain certification, you will need to:

- Develop and maintain a secure system and network;

- Have a vulnerability management system;

- Establish strict access control standards;

- Protect confidential information;

- Constantly test and monitor networks;

- Maintain and update data security policies.

Currency conversion

Real-time currency calculation and conversion are extremely complex. You need to create a mechanism that processes currency conversion and fund transfers in the shortest possible time. To do this, you will have to enter into agreements with banks operating in the digital currency market.

Lack of legal protection

In many regions, one of the main security risks in P2P is legal protection from traditional banking institutions. For example, if you authorize a payment to a fraudster, getting a refund through the platform may be difficult, unlike credit card fraud, where refunds are a standard procedure.

Considering all these nuances, it will be safer for you to kick off a guaranteed stable app development workflow run by reliable specialists from the get-go. Just make sure to settle on the budget.

How Much Does It Cost to Create a Custom P2P Payment App?

Creating a quality application requires a lot of time, know-how, and experience. The final cost of development is shaped by such aspects as:

- Urgency of launch - the faster you need to bring the product to market, the more resources you'll have to invest.

- Type of app and tech stack - developing applications for multiple platforms using innovative tools requires more expertise, so it's usually more expensive.

- Scope of features - advanced features enhance user interaction but increase costs.

- Complexity and number of integrations - seamless interaction with payment gateways, compatibility with multiple platforms, and strict security levels can only be achieved with the help of Senior specialists.

- Developer rates - they depend a lot on geography. For instance, in the USA and Canada, average rates are significantly higher than in Eastern Europe.

Based on our experience, the total price of a P2P software project averages between $25,000-$50,000. A basic application without many features can cost up to $100,000 or more. A moderately complex application with enhanced functionality and security can cost up to $150,000, while the final cost of an advanced app with global payment gateways and integration of third-party services can easily exceed $200,000.

Conclusion

Considering the importance of the task, your team will need to thoroughly understand the nuances of P2P applications and payment systems. To gain advantages, you'll need to study the market and consider the latest user trends. This requires expertise, time, and effort, especially in a relatively niche segment of P2P development. The safest option is to turn to expert softwaredevelopment company.

The EXB Soft team is always ready to take on any scope of development and business needs. We offer a rich experience, a grip on the latest tech, and a flexible collaboration model that will allow you to build a P2P payment app that stands out and profits. Contact us to build your own development team.

F.A.Q

Mobile OS-compatible P2P payment apps, such as Android Pay and Apple Pay, are integrated into the operating systems of mobile devices and primarily support NFC technology for transactions within the same system. Bank-centric P2P payment apps, like Dwolla and Zelle, facilitate fund transfers through partner banks and credit unions, allowing users to manage finances directly via their existing bank accounts and often integrate with traditional banking applications or POS terminals.

Standalone P2P payment apps, such as PayPal and Venmo, use robust security measures including encryption, two-factor authentication, and secure storage of funds within a protected system. These apps have their own autonomous management and asset security systems, ensuring that user transactions are conducted safely and securely.

Must-have features for a P2P payment app include a digital wallet, currency conversion capabilities, unique ID/OTP verification, push notifications, in-app chat support, transaction history, and responsive customer support. These features ensure secure financial management, real-time updates, and easy communication, enhancing the overall user experience.

Biometric authentication, such as fingerprint scanning and facial recognition, adds an extra layer of security to P2P payment apps by ensuring that only authorized users can access the app and perform transactions. This reduces the risk of unauthorized access and enhances the overall security of the app.

Common challenges include geographical limitations, dispute resolution, lack of open-loop solutions, security vulnerabilities, compliance with PCI DSS, currency conversion complexities, and lack of legal protection. These can be addressed by thorough planning, adherence to local regulations, robust security measures, real-time transaction monitoring, and collaboration with experienced development teams.

Factors influencing the cost include the urgency of the launch, type of app and technology stack, scope of features, complexity and number of integrations, and developer rates based on geography. Advanced features and multi-platform compatibility increase costs, while faster time-to-market requires more resources.

Compliance with PCI DSS standards is crucial for protecting confidential banking information and ensuring secure transactions. Key requirements include developing and maintaining secure systems and networks, implementing a vulnerability management system, establishing strict access control standards, protecting cardholder data, regularly testing and monitoring networks, and maintaining a data security policy.