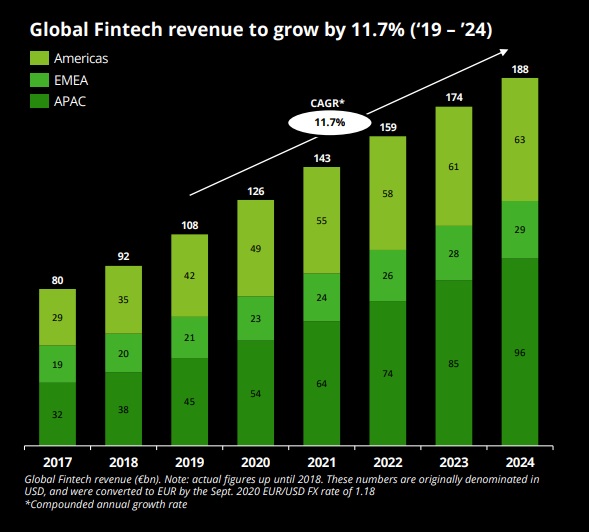

Today, the financial industry is one of the most digitalized sectors of the world economy. High-tech innovations transform the domain and keep the fintech market at a steady CAGR of 11.7%.

Given such mouth-watering business prospects, it is no wonder that the number of fintech startups worldwide more than doubled since 2019 and currently exceeds 26,000 . To hit it big in such an oversaturated niche, entrepreneurs planning to launch a fintech app or any other product in this field must pay attention to financial technology trends that dominate the sphere.

What fintech trends 2023 has witnessed coming, which are likely to stay relevant in the next year as well?

Zooming in on Disruptive Trends in Fintech

Let’s have a look at fintech market trends that shape the contours of the industry and will continue to do so in the foreseeable future.

1. Buy now, pay later (BNPL)

This extremely consumer-friendly system allows people to start using an item after paying only an initial installment on it (typically via a point-of-sale). The rest of the balance is defrayed later at the client’s convenience. Customers who opt for BNPL loans do so because of the flexibility and foolproof nature this scheme provides with low (sometimes even zero) interest rates, which enables card owners with a low credit limit to enjoy big-ticket products.

Businesses that institute BNPL practices end up in the black as well since, by offering competitive payment conditions and interest rates, they can boost sales and foster long-term customer loyalty. For instance, Amazon and Affirm propose dividing $50+ purchases into smaller amounts a buyer can pay monthly.

The win-win character of the BNLP system explains the spike in its popularity, with the global market expected to reach $67 million by 2025 – an almost 2.8 times increase against 2020. The major challenge the market has to address is consumers missing regular installments, but it can be overcome through scheduling automated payments by merchants or banks.

2. Neobanks

The broad advent of remote practices boosted by the global pandemic has caused the appearance and rapid growth of neobanks. Unlike traditional financial institutions, these exist only virtually – in users’ gadgets – and have no brick-and-mortar facilities. The absence of the necessity to cover physical location expenditures allows such organizations to reduce the cost of banking services and thus offer their clients competitive fees. Other perks of digital-only banks include:

- Fewer set-up regulatory requirements (and thus less startup investments)

- Enhanced user experience with clients having round-the-clock access to instant services

- A high degree of service automation

- Simple cryptocurrency integration

These upsides outweigh the minor downsides of neobanks, the chief of which is their limited range of services. Yet, it can be viewed as a plus since they tend to be of higher quality because digital-only organizations can focus on the fewer categories of services they deliver. People are definitely of the same opinion, which is vindicated by statistics. According to an eMarketer report, the number of neobanks’ clients will exceed 53 million in 2025 – a tremendous rise in comparison with 29.8 million two years ago.

3. Virtual cards

If banks can be digital-only, why can’t bank cards follow suit? In fact, they do. People never get a chance to hold a piece of plastic in their hands when they get a virtual card. Being issued both by neobanks and traditional institutions, they live only inside a client’s gadget, in their digital or e-wallet, to be precise. Consumers pay with them in online or physical stores and can forget about the worries of losing money because of card fraud schemes. Why? Because every purchase paid for via the virtual card must be authorized through the personal banking app. Moreover, some banks issue disposable virtual cards whose details change after each transaction – one of the security-driven fintech trends.

4. Open banking

Creating a one-stop-shop system for numerous businesses requiring access to a person's finances is one of the current fintech industry trends. In their turn, people receive an opportunity to pay for services and goods in a no-sweat and fast way. Banks implement such mutually beneficial financial information exchange, allowing retailers, insurance companies, and other third-party agencies to get payments from the client's account via open APIs. This approach has manifested its efficiency in other finance-related use cases, like budgeting, expense tracking, lending, and more. Naturally, the successful practices of open banking led to an exponential increase in the clientele, which in 2024 is expected to grow five times in comparison with 2020 and reach 132.2 million globally.

5. Embedded finance

Another variation of the one-stop-shop concept comes especially handy for e-commerce businesses and their customers. With this system in place, entrepreneurs can receive credits on short notice, and consumers can pay for products they buy via online stores. But not only that. People can make hassle-free payments in transportation, healthcare, insurance, and other spheres.

A peculiar example of embedded finance is a fintech super app. Leveraging one single application, people can cater to all their financial needs and make use of a broad gamut of respective services in a few clicks. The unquestionable fortes of fintech super apps are their low entry barrier (compared to classic fintech products) and ubiquity. The former stems from the fact that they are built on existing platforms (like social networks or messengers), which people are used to. The latter relates to their mobile-first nature, enabling billions of smartphone owners to conduct financial transactions.

6. Contactless technology

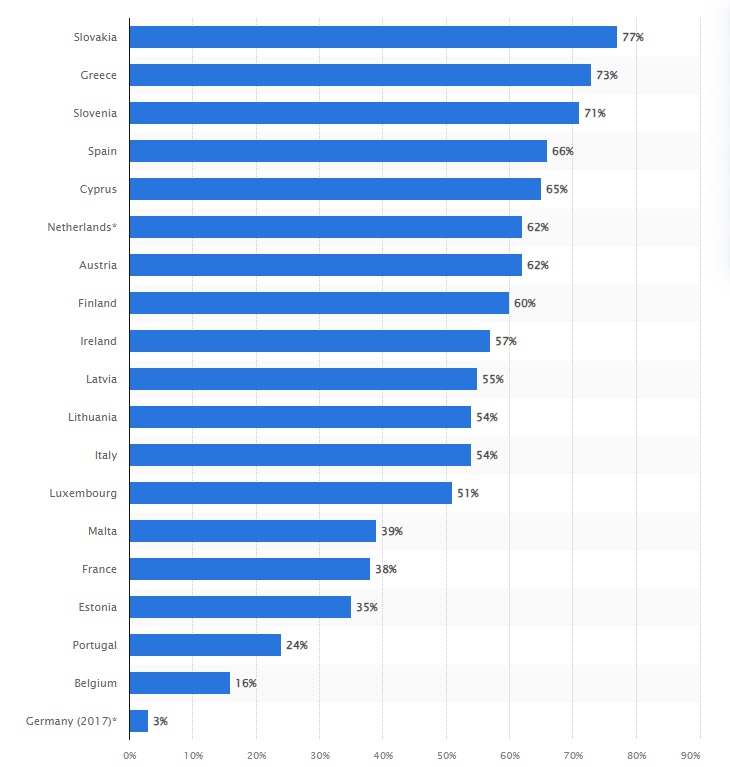

Contactless payments’ expansion is one of the top fintech trends nowadays. Even several years ago, the percentage of such transactions was huge across the Euro area.

Now, it is likely to carry the day not only in Europe but worldwide. Two factors account for the pervasive spread of this know-how.

The first is the ongoing EMV chip card adoption. Being more secure than old-school magnetic stripe cards, they appeal to an ever-growing number of consumers and businesses. The second is the progressing acceptance of near-field communication-powered devices as a payment mechanism. NFC-equipped smartphones, watches, and other gizmos are becoming integral to our IT-fueled consumer landscape, encouraging enterprises to embrace innovation and set up NFC terminals across their outlets.

7. Alternative lending

Also known as P2P lending, this mechanism is especially popular in South-East Asia, where people tend to rely on internal resources more than on the conventional loan system favored internationally. At alternative lending platforms, borrowers and investors can come into contact and get engaged in several types of services.

- Direct lending. You borrow money from an organization that isn’t a bank.

- Debt financing. It includes home equity loans, recurring revenue lending, and other cash flow operations performed by non-banks.

- Venture debts. These are preferred by companies that hate losing equity to funding rounds.

- Structured equity products. They come as pre-packaged investment options, where the borrowing company issues debt securities (for instance, bonds).

8. Regtech

The banking and financial realm is one of the most heavily regulated sectors. State bodies adopt an enormous amount of rules, laws, and standards financial actors must comply with under the threat of hefty fines. But given this deluge of regulations (which never wanes but only waxes year after year), it is impossible to keep track of them, to say nothing of observing them. For a human, but not for a machine.

Regtech is the range of cutting-edge solutions honed to monitor regulatory compliance. They process a slew of clients data, verify their accuracy, track the legality of transactions and other financial operations in accordance with the AML framework, analyze risks, and detect fraud. Besides, regtech software is highly instrumental in creating compliance reports and automating contacts with regulatory authorities.

9. Proptech

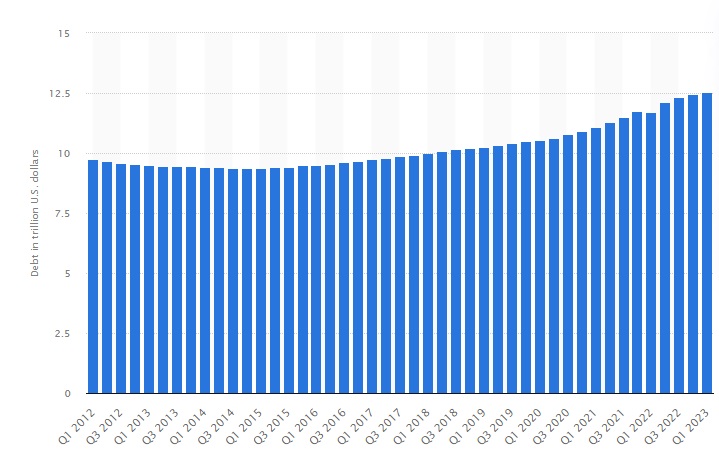

Owning a home of their own is a cherished desire for people across the globe, and in the most powerful economy of the world, it is a vital element of the American Dream. No wonder citizens borrow heavily in the USA to make this dream come true.

Despite their high demand (or perhaps because of it), mortgage loans are highly bureaucratized. Proptech solutions help cut down on the time and effort people spend applying for a mortgage, get the green light, and repay it, observing all regulatory documents.

10. Decentralized finance

The De-Fi concept is grounded on distributed ledger technology (DLT), having its roots in blockchain know-how. Its decentralized nature allows financial actors to avoid the mediation of banks and brokers in using financial products and services. With the transaction ledger maintained by all network members, operations in it become lightning-fast, secure, cost-efficient, and supervision-free.

The DLT use cases in finance embrace all kinds of money transfers, loans, payments, trading, etc. Besides, the De-Fi technology enables enhanced data protection, conduct identification and verification, transaction registration, contract signing, fraud reduction, and other domain-specific activities.

11. Biometric authentication

The safety of personal data and the inviolability of money in their bank accounts is the primary concern of 93% of modern financial service consumers. But the truth is that reliance on passwords many fintech products practice today can’t provide the level of security they crave. The future belongs to biometric identity verification procedures that are becoming increasingly relevant with the rapid spread of digital banking.

Biometric identification not only steps up fintech security and prevents fraud but also offers a more satisfying user experience. By equipping their fintech solutions with mechanisms based on retina or fingerprint scans, facial or voice recognition, palm geometry screening, or keystroke dynamics tracking (or several of them taken together), financial organizations spare their clients the necessity to learn intricate letter and number combinations and remember it again when they renew it annually.

Although fraught with certain technical difficulties, biometric identification is gaining ever wider traction nowadays. The market that was worth under $43 billion last year is predicted to increase almost twofold by 2027 and reach $83 billion.

12. Voice assistants

Modern fintech developers realize that Alexa-style software speaking from within your gadget is very helpful in financial matters. Such mechanisms can be employed for checking balances, purchasing products, booking reservations, paying bills, and doing other things related to finances. The roster of services enabled through voice commands is steadily growing – as well as the number of voice assistants in general. In 2025, it is expected to equal 8.4 billion, which is more than the planet's human population!

13. Gamification

Although finances are a serious business, embedding a tinge of gaming into fintech solutions can improve their client-facing capabilities. By initiating various bonus programs with digital awards, badges, in-app coins, and other remuneration techniques, financial institutions take robust steps on the way to customer retention, revenue enhancement, and fostering brand loyalty.

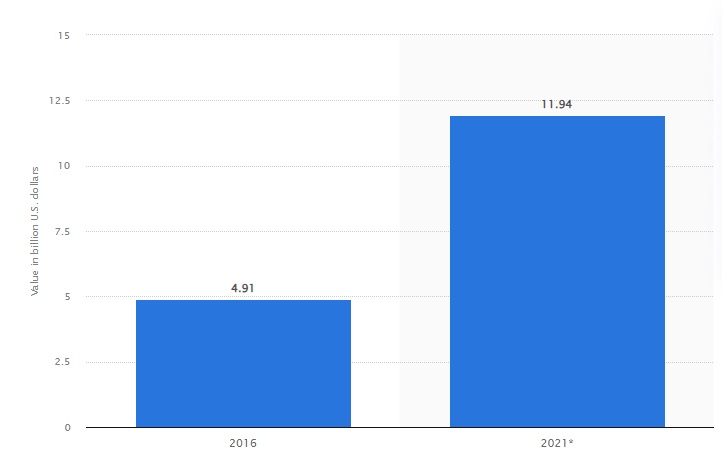

This instrument's efficiency aimed at increasing the competitive power of fintech organizations is proved by the steeply growing budgets they allocate for embracing gamification.

14. Modularity and microservices

All the fintech trends listed above increase the need for flexible and adjustable professional solutions. It means that software developers should prioritize microservices over monolithic architecture while building fintech products. By harnessing microservices, they will usher in the following benefits.

- Fast development due to the ability to create any element separately.

- Scalability and reusability of modules from previously built products for new projects.

- Reliability of functioning and minimization of product crash risks

- Easy integration thanks to open APIs, enabling microservices solutions to play well with other ecosystem elements.

- No-sweat maintenance explained by the ability of every individual microservice to be revamped, updated, and redeployed without affecting the performance of other elements and the solution as a whole.

15. AI and ML

Numerous use cases harnessing these technologies can’t be considered the latest fintech trends since it has been happening for a while. However, Artificial Intelligence and Machine Learning tools are at the top of the tech stack list for developing fintech apps or other software.

Typically, they are leveraged for creating chatbots employed in customer self-service. Yet, in fact, AI and ML can revolutionize multiple aspects of financial organizations workflow, including preventing and combating fraud, automating numerous pipeline activities, collecting and processing various data, offering insights into customer behavior, introducing robo-advisors for financial guidance, budget optimization, and payment management, etc.

All the crucial benefits AI and ML in fintech can bring account for the CAGR of over 23% this market field is predicted to display until 2026, reaching $26.67 billion worth by that time.

Summing It up

In our IT-driven world, financial organizations with big-time aspirations have no other choice but to leverage top-notch fintech software and stay abreast of the latest trends in the niche. It means not only embracing novel technologies (contactless payment, AI and ML, De-Fi, microservices, virtual cards, biometric authentication, proptech, regtech, etc.) but also implementing novel approaches to financial operations, such as open and neobanking, embedded finance, BNPL, alternative lending, and gamification.

As you see, developing a cutting-edge, efficient fintech solution is a no-nonsense job that must be entrusted to vetted professionals in the realm. Seasoned fintech specialists of EXB Soft possess the necessary skills and experience to deliver a niche solution of any type, scope, and complexity that will impress you with seamless functioning, neat design, and moderate price.